Fundrise Review

Introduction — Reviewing the Fundrise Investing App

For many individual investors, real estate has long been a sought-after asset class but often remains out of reach due to the high capital requirements and intricacies of property management. With the advent of online platforms like Fundrise, however, the landscape is shifting. Righteous Money’s Fundrise review delves into this popular real estate investing platform.

It is a highly accessible way to access real estate private markets. Is it a good fit for your portfolio?

Total Fundrise Review Score:

Crowd Composite: 3.73

Righteous Money score: 4.5

Average: 4.12

Fundrise Review Roundup

Righteous Money likes the wisdom of the crowd! We’re smart; the internet, in totality, is smarter. So we take a “weighted scoring” approach, looking at the review sources that take a more objective assessment of the platform. (Many online reviews of investment and personal finance platforms are done by paid affiliates who are overly incentivized to review positively.)

Here’s what other reputable reviewers have to say about Fundrise, in aggregate:

Google Reviews — 4.3

CrowdDD — 2.9

Trustpilot — 2.0

Nerdwallet — 5.0

Weighted Fundrise Review Composite Score: 3.73

Fundrise History and Track Record

Fundrise, founded in 2012 by Ben and Dan Miller, was among the pioneers that democratized real estate investing. Even before the JOBS Act was signed (making “real estate crowdfunding” legally possible) the “Brothers Miller” were lobbying in DC to spur deregulatory measures and open the door for more access to real estate private markets. Not coincidentally, the company was founded in Washington DC and is still headquartered there. The company was filing investor documents with the SEC as early as 2015.

Using technology, Fundrise aims to make high-quality real estate investments accessible to the individual investor. With over a decade in the business, the platform has garnered significant attention, notably for its eREITs (electronic Real Estate Investment Trusts) which allow users to invest with as little as $500.

What is Fundrise’s track record? On the plus side, they’ve been at it for a lot longer than other real estate crowdfunding platforms. They prioritize diversified funds, which is appropriate for non-accredited investors (your eggs aren’t all in one basket). They are very transparent about historical results, which is encouraging.

You’ll notice that their aggregate returns show a lot less volatility than public REITs or the stock market. This is part of the overall thesis of private-market real estate. It may not have the ups of the stock market, but over time performance tends to be more stable in aggregate. Fundrise has a spread of about 13 points between its worst and best quarters ever, whereas that spread is 42 percentage points for public REITs and 40 points for the stock market over the same period. The avg. income return is a fair amount higher than these other asset classes too.

How Does Fundrise Work?

Fundrise offers a selection of diversified portfolios which cater to a range of investment goals, from supplemental income to balanced investing and long-term growth. Their eREITs and eFunds offer both debt and equity real estate investments, with properties spread across the U.S. Significantly, Fundrise allows for individuals to get started investing in real estate with just $500.

The platform operates on a real estate crowdfunded model — from a legal and regulatory standpoint, their offerings are structured as Reg A or Reg A+. When investors put in their money, Fundrise pools these funds to invest in real estate properties. This pooling system allows for lower minimum investments, making real estate more accessible.

The Fundrise platform is really styled as a robo-advisor. From a UX and offering perspective it’s clearly emulating Betterment.

As of 2023, investors can also allocate to their “innovation fund,” which targets pre-IPO startups, plus a range of real estate fund options.

Fundrise ESG and Impact Investing Considerations

Fundrise has shown a commitment to sustainable and responsible investing. They've incorporated ESG (Environmental, Social, and Governance) factors into their investment criteria. For instance, Fundrise has invested in green buildings and sustainable infrastructure projects.

Additionally, the platform's emphasis on revitalizing neighborhoods aligns with impact investing principles, aiming for a positive societal impact alongside financial returns.

The Righteous Money Take

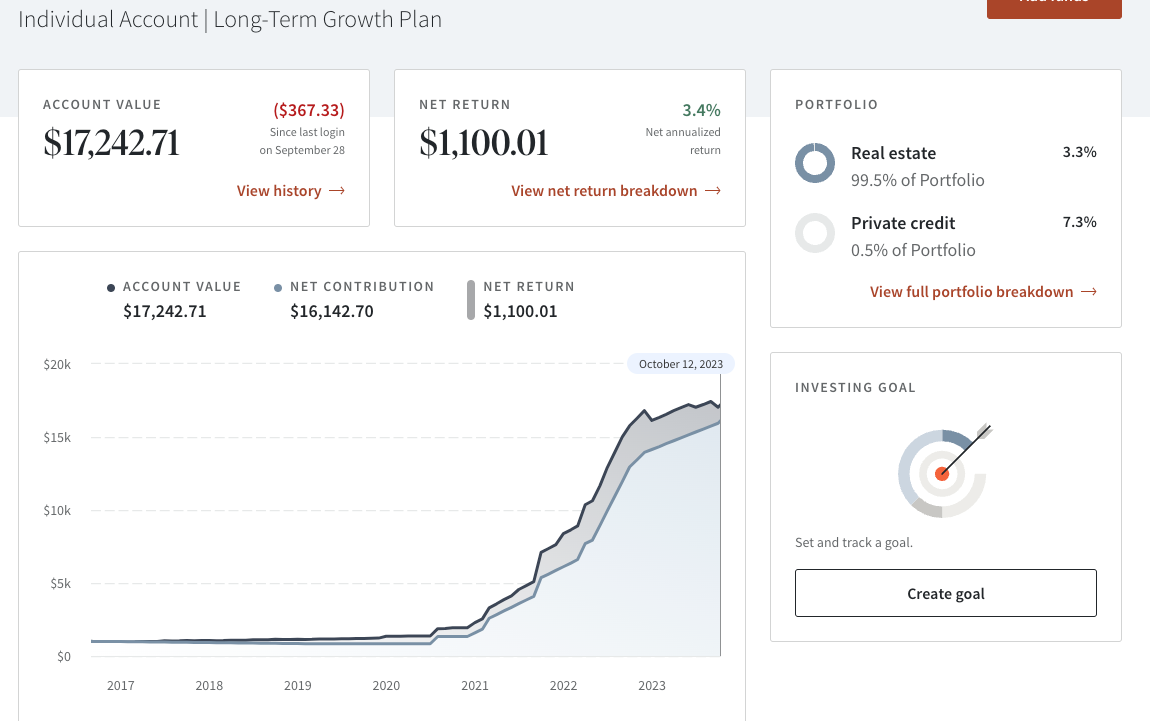

I have been investing a small amount with Fundrise for a few years. Given modest monthly contributions, my hope is this can turn into a college tuition for one of my kids (or at least a meaningful percentage). For now this is really small beans, but enough to get a sense of the customer experience and performance.

2023 has been a rough year for real estate, so it isn’t too surprising (or damning) to have a downswing this year. Overall my portfolio is positive and I get “beer money” type distributions quarterly.

My major takeaways:

Clean and highly functional UX

Good “set it and forget it” robadvisor type CX for a non-accredited investor

Returns are not spectacular so far, but do show the kind of stability you would hope for out of a real estate investing platform.

Righteous Money Fundrise Review: 4.5/5

Fundrise Review Conclusion: Is Fundrise Right for You?

Fundrise offers an intriguing proposition for those seeking to diversify their portfolio with real estate. While it simplifies the process considerably, it's crucial for potential investors to understand the inherent risks associated with real estate. As with all investments, it's recommended to do your due diligence, consult with financial professionals, and consider your risk tolerance.

That said, it’s the clear market leader for a non-accredited platform. The extensive corporate history and breadth of assets under management lend confidence to any investor just getting started in diversifying into real estate. Righteous Money recommends!

Disclaimer: This review is meant for informational purposes only and is not financial advice. Always consult with a financial advisor before making any investment decisions.